Why Submitting an Online Tax Return in Australia Is the Fastest Means to Obtain Your Refund

Why Submitting an Online Tax Return in Australia Is the Fastest Means to Obtain Your Refund

Blog Article

Navigate Your Online Income Tax Return in Australia: Crucial Resources and Tips

Navigating the on the internet tax return procedure in Australia requires a clear understanding of your commitments and the sources readily available to enhance the experience. Crucial documents, such as your Tax Data Number and revenue declarations, should be diligently prepared. Selecting an appropriate online platform can dramatically impact the performance of your declaring procedure.

Understanding Tax Obligation Responsibilities

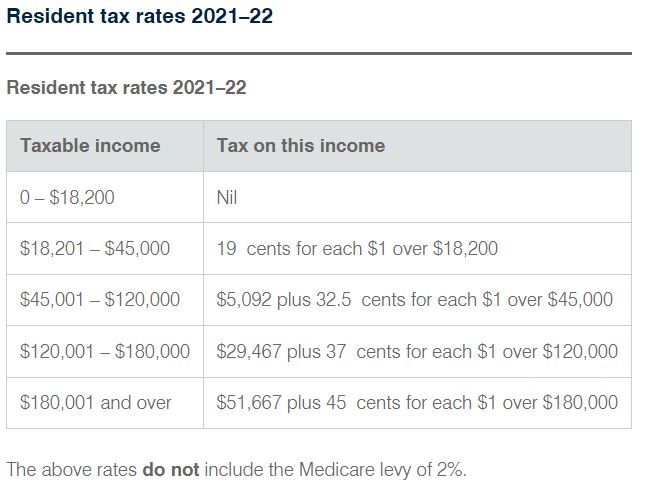

People must report their income accurately, which includes salaries, rental earnings, and investment profits, and pay tax obligations as necessary. Locals must understand the difference between non-taxable and taxable income to guarantee compliance and optimize tax obligation outcomes.

For companies, tax responsibilities incorporate several elements, consisting of the Item and Provider Tax Obligation (GST), business tax, and payroll tax obligation. It is essential for services to sign up for an Australian Company Number (ABN) and, if appropriate, GST registration. These responsibilities require thorough record-keeping and prompt entries of tax returns.

In addition, taxpayers ought to know with offered deductions and offsets that can relieve their tax obligation concern. Consulting from tax obligation professionals can give beneficial insights into enhancing tax settings while ensuring conformity with the legislation. In general, a comprehensive understanding of tax obligations is important for effective financial planning and to prevent charges associated with non-compliance in Australia.

Vital Files to Prepare

Additionally, assemble any type of appropriate bank statements that reflect rate of interest income, in addition to returns declarations if you hold shares. If you have various other incomes, such as rental properties or freelance job, ensure you have documents of these revenues and any type of connected expenses.

Don't forget to include deductions for which you may be qualified. This might include invoices for occupational expenses, education expenses, or philanthropic contributions. Last but not least, think about any type of exclusive health insurance policy declarations, as these can affect your tax obligation obligations. By collecting these crucial papers beforehand, you will certainly streamline your on-line tax obligation return procedure, decrease mistakes, and take full advantage of prospective reimbursements.

Picking the Right Online System

As you prepare to submit your online income tax return in Australia, choosing the best system is necessary to make certain accuracy and simplicity of use. A number of key variables must direct your decision-making process. Take into consideration the platform's user interface. A straightforward, intuitive style can substantially improve your experience, making it less complicated to browse complicated tax forms.

Next, evaluate the platform's compatibility with your economic situation. Some services provide specifically to people with straightforward income tax return, while others offer comprehensive support for extra complex situations, such as self-employment or financial investment revenue. Moreover, try to find platforms that use real-time error monitoring and advice, aiding to reduce mistakes and making certain compliance with Australian tax obligation legislations.

Another vital aspect to take into consideration is the degree of client support available. Trustworthy systems must supply access to support through email, conversation, or phone, especially throughout height filing durations. In addition, research study user evaluations and ratings to determine the general contentment and integrity of the system.

Tips for a Smooth Filing Refine

Submitting your on the internet tax obligation return can be a straightforward process if you adhere to a few essential pointers to ensure effectiveness and precision. This includes your income statements, receipts for reductions, and any kind of other relevant documents.

Following, make use of the pre-filling feature used by several online platforms. This can save time and minimize the opportunity of mistakes by immediately occupying your return with details from previous years and data i was reading this provided by your employer and banks.

In addition, ascertain all entries for accuracy. online tax return in Australia. Errors can cause postponed reimbursements or concerns with the Australian Taxes Workplace (ATO) Make sure that your personal information, income figures, and deductions are appropriate

Declaring early not only lowers anxiety yet also allows for far better preparation if you owe tax obligations. By complying with these tips, you can browse the on the internet tax obligation return process efficiently and with confidence.

Resources for Assistance and Assistance

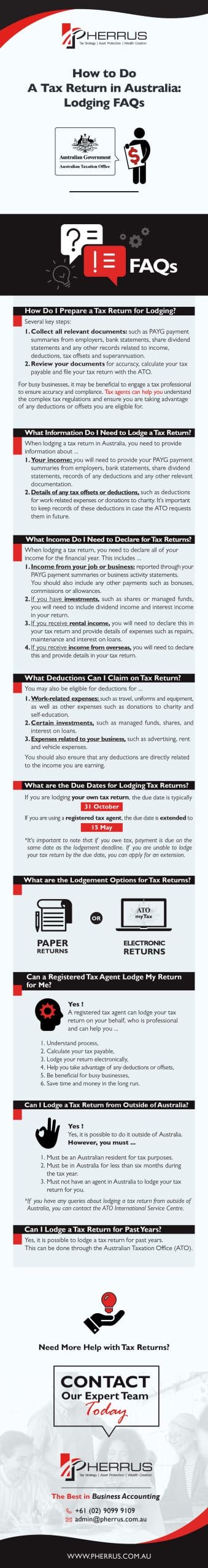

Navigating the intricacies of on the internet income tax return can often be daunting, however a variety of sources for assistance and assistance are readily offered to help taxpayers. The Australian Tax Workplace (ATO) is the main resource of information, supplying extensive overviews on its website, consisting of FAQs, training video clips, and live chat choices for real-time assistance.

Additionally, the ATO's phone support line is available for those who favor straight interaction. online tax return in Australia. Tax specialists, such as licensed tax obligation representatives, can also offer personalized assistance and make certain conformity with existing tax obligation go right here policies

Final Thought

To conclude, effectively navigating the online tax return process in Australia calls for an extensive understanding of tax obligation commitments, thorough prep work of essential documents, and mindful selection of an appropriate online platform. Abiding by practical tips can enhance the declaring experience, while readily available sources supply beneficial aid. By coming close to the process with diligence and attention to detail, taxpayers can make certain compliance and make best use of potential advantages, eventually contributing to an extra reliable and effective income tax return end result.

As you prepare to file your on-line tax return in Australia, selecting the ideal platform is crucial to make sure accuracy and convenience of use.In verdict, efficiently browsing the on the internet tax obligation return process in read this article Australia calls for a complete understanding of tax responsibilities, meticulous prep work of important papers, and careful option of a suitable online system.

Report this page